2022 tax brackets calculator

Under 65 Between 65 and 75 Over 75. See where that hard-earned money goes - with Federal Income.

Casio Sl797tvblack Tax Calculator In 2022 Calculator Casio Tax

The 2022 Tax Year in Canada runs from January 2022 to December 2022 with individual tax returns due no later than the following April 30 th 2023.

. 10 12 22 24 32 35 and 37. The Tax Rates for a particular tax year is very important when we perform any calculation. Finally Illinois enacted an optional pass-through entity tax for 2022 through 2025.

It is mainly intended for residents of the US. The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. 2022 free Canada income tax calculator to quickly estimate your provincial taxes.

The 2020 standard deduction allows taxpayers to reduce their taxable income by 4601 for single filers 9202 for married filing jointly head of household and qualifying. Please note that Jamaica uses a split annual tax calculations which. Estimate your tax refund with HR Blocks free income tax calculator.

There are seven federal tax brackets for the 2021 tax year. The lowest tax bracket or the lowest income level is 0 to 9950. Your Federal taxes are estimated at 0.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Explore 2021 tax brackets.

Up to 10 cash back TaxActs free tax bracket calculator is an easy way to estimate your federal income tax bracket and total tax. Tax Card for Tax Year 2022 Download Online PDF. 2022 Tax Calculator 01 March 2021 - 28 February 2022 Parameters.

The state income tax rates are 495 and the sales tax rate is 1 for qualifying food drugs and medical. Its never been easier to calculate how much you may get back or owe with our tax estimator tool. Calculate your income tax bracket 2021 2022 Filing Status Total Expected Gross Income For 2021 Show Advanced Options Calculate Your 2021 Income Tax Bracket.

Your bracket depends on your taxable income and filing status. This is 0 of your total income of 0. The IRS changes these tax brackets from year to year to account for inflation and other changes in economy.

The personal income tax rates rates below for resident and non-resident income tax calculations are for the 2022 tax year. Some Tax rates may change every. It is taxed at 10 which means the first 9950 of the.

The IRS has set seven tax brackets 2022 taxpayers will fall into. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Your tax bracket is. This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income. There are seven federal income tax rates in 2022.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. You can also create your new 2022 W-4 at the end of the tool on the tax. 0 would also be your average tax rate.

2022 Income Tax in Canada is. The top marginal income tax rate. The calculator reflects known rates.

2022 Personal tax calculator EY Canada 2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory. US Income Tax Calculator 2022 The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The new 2018 tax brackets are.

In tax year 2020 for example a single person with taxable income. Total Expected Gross Income. And is based on the tax brackets of 2021 and.

This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. The 2022 Tax Year in Canada runs from January 2022 to December 2022 with individual tax returns due no later than the following April 30 th 2023. As of 2016 there are a total of seven tax brackets.

Daily Weekly Monthly Yearly.

Tax Calculator Refund Return Estimator 2021 2022 Turbotax Official

Pin On Financial Ideas

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Tax Calculator Estimate Your Income Tax For 2022 Free

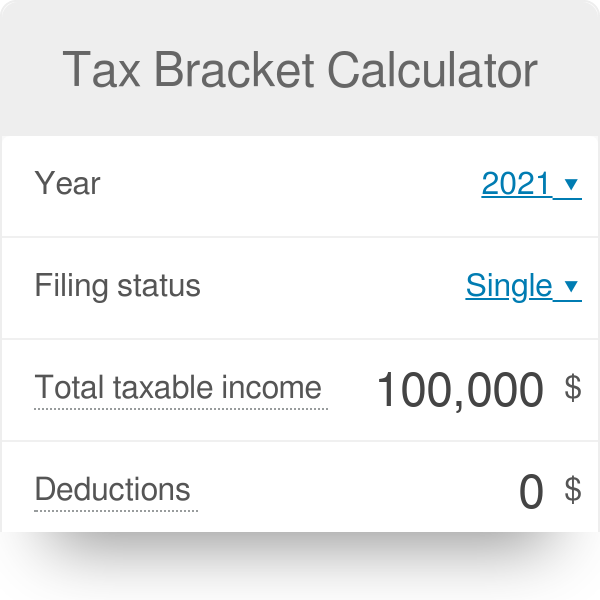

Tax Bracket Calculator

Taxfyle Com Tax Bracket Calculator Income Tax Brackets Tax Brackets Filing Taxes

Tax Percentage Calculator In 2022 Online Taxes Tax Saving Investment Online Income

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

Python Income Tax Calculator Income Tax Python Coding In Python

Self Employed Tax Calculator Business Tax Self Employment Self

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Irs State Tax Calculator 2005 2022

Sales Tax Calculator

Tax Calculation Spreadsheet In 2022 Spreadsheet Template Spreadsheet Excel Formula