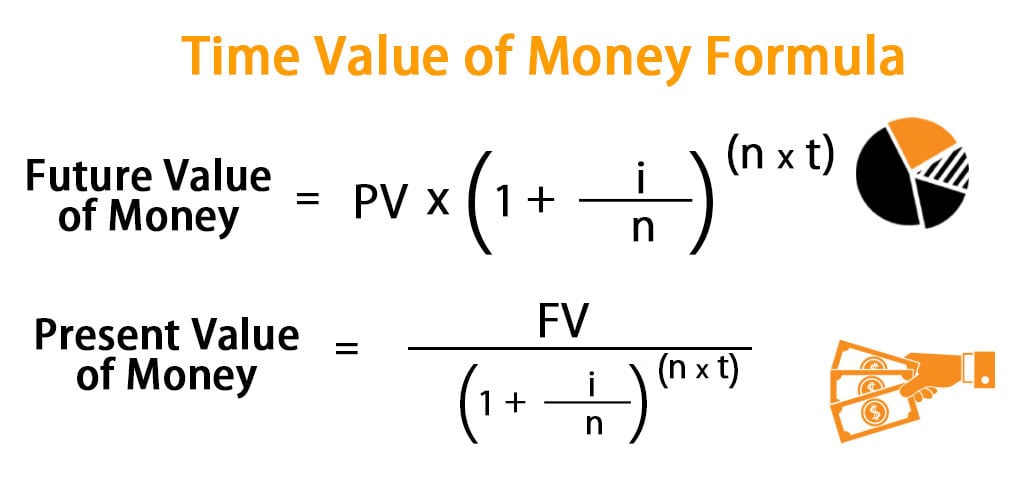

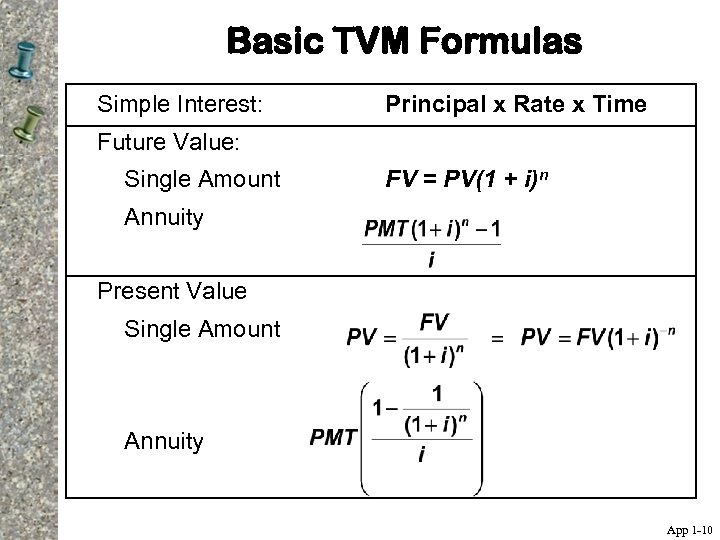

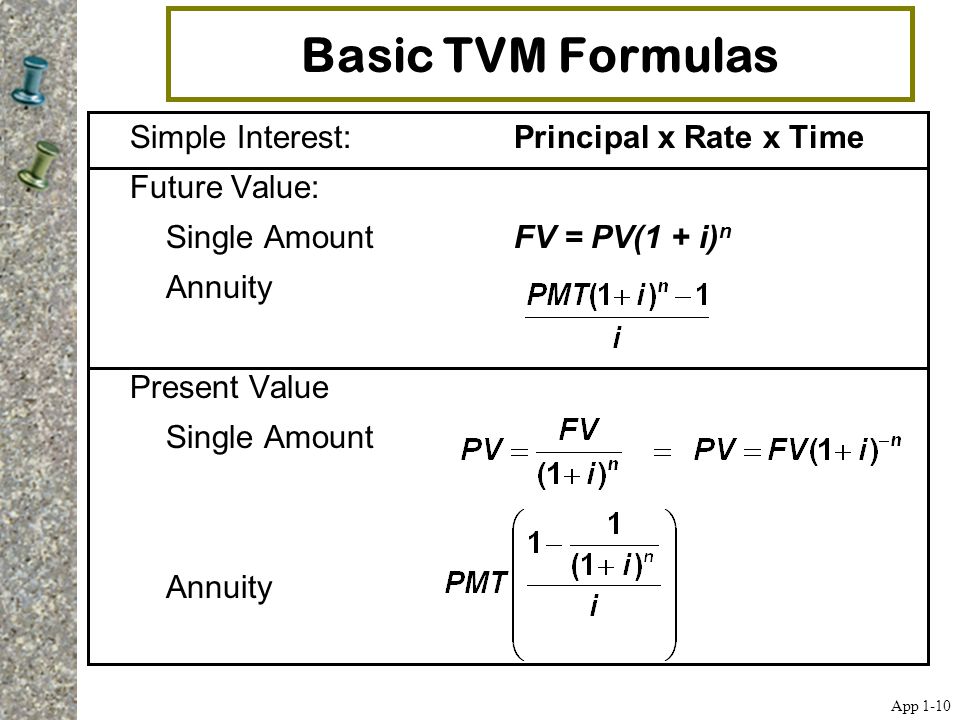

Tvm calculation formula

Formula to Calculate PV of Ordinary Annuity. 24 Feb 2021 at 904 am.

Time Value Of Money Explained With Examples Magnimetrics

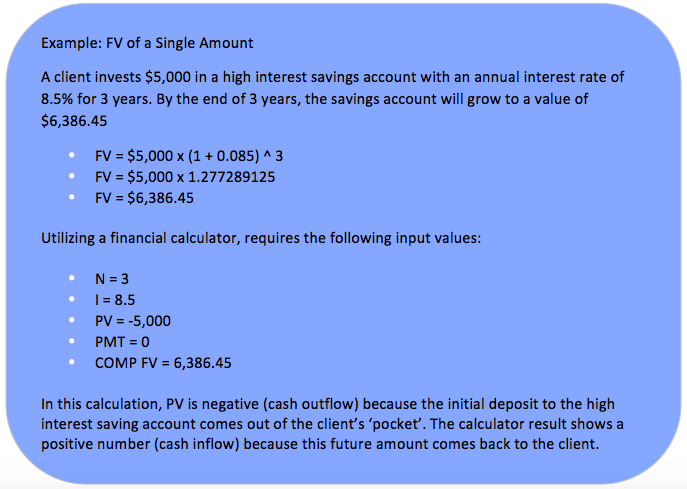

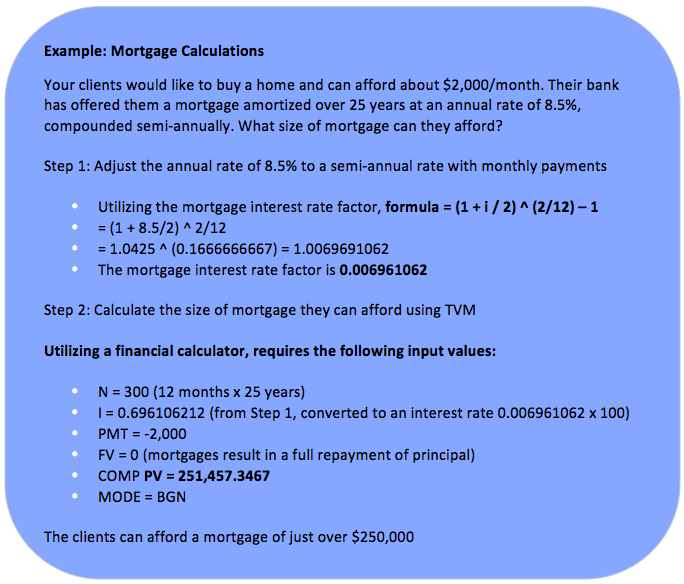

Thus the calculation for our example is as follows.

. 16 Feb 2021 at 1231 pm I dont get information like PB after NPV. FV 10 million 1 10 4 4 x 1 1104 million. The debt ratio is a calculation that shows the percentage of a companys total liabilities that are funded by debt.

Let us understand the TVM calculation through the following Time Value of Money example. The market cap represents the value of the entire company to only one group of capital providers which is the common shareholders. Read more of 20 Div 1 next year and 216 Div 2 the following.

It is necessary to be considered in the calculation of equity ratios. Moreover using the same formula as above we can calculate the future value FV assuming quarterly compound interest ie. Total liabilities and total assets.

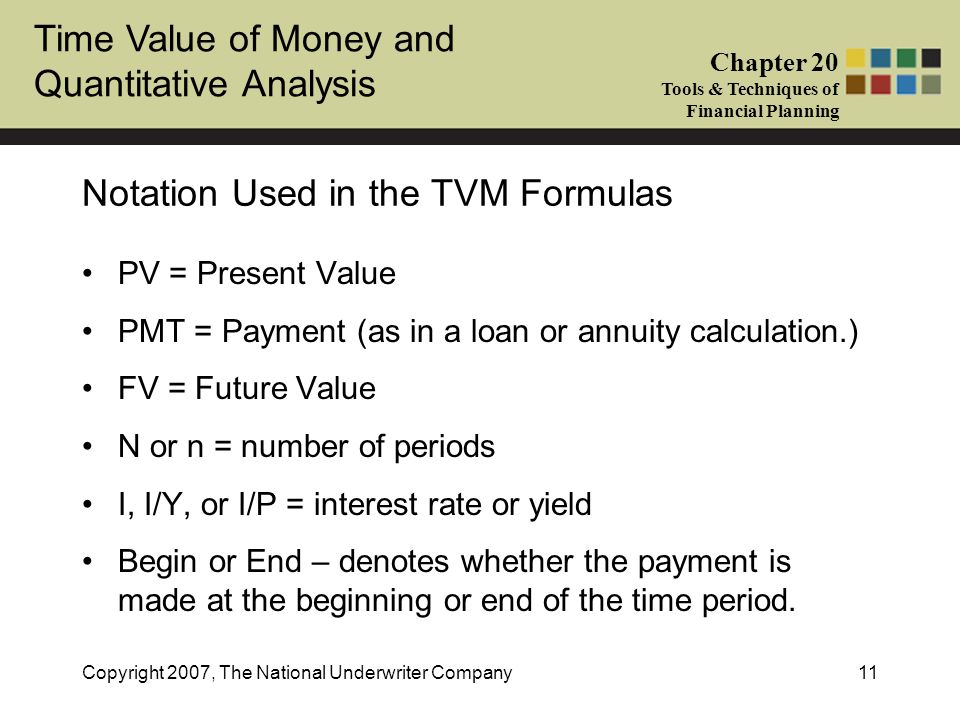

For loan calculations we can use the formula for the Present Value of an Ordinary Annuity. A long-term debt ratio of 05 or less is considered a good definition to indicate the safety and security of a business. Before starting each TVM calculation.

Continuous compounding is the mathematical limit that compound interest can reach. So you can think of a loan as an annuity you pay to a lending institution. Youll just have to use the formula and build up your answer from there.

It is also known as the debt to asset ratio. How is the debt ratio calculated. Find the Loan Amount.

I only get NPV and I. The debt ratio formula requires two variables. Mario purchases a stock expected to pay dividends Dividends Dividends refer to the portion of business earnings paid to the shareholders as gratitude for investing in the companys equity.

As per the formula the present value of an ordinary annuity is calculated by dividing the Periodic. This can be tedious to do by hand. Technically you could also use the IRR function but there is no need to do that when the Rate function is easier and will give the same answer.

The long-term debt ratio is a figure that indicates the percentage of total assets value given by the long-term debts. Ordinary Annuity Formula refers to the formula that is used to calculate the present value of the series of an equal amount of payments that are made either at the beginning or end of the period over a specified length of time. It is an extreme case of compounding since most interest is compounded on a monthly quarterly or semiannual.

What is a good long-term debt ratio. To calculate the YTM in B14 enter the following formula. Press the 2nd key and the FV key to clear the TVM worksheet Input -250 and press the PMT key the 250 payment will be negative cash.

The results can be expressed in percentage or decimal form. To calculate the enterprise value of a company you first take the companys equity value and then add net debt preferred stock and minority interest. Our starting point the equity value ie.

40x times a year. Fortunately the Rate function in Excel can do the calculation quite easily.

Time Value Of Money Tvm What It Means How It S Used Etc

Tvm Calculations

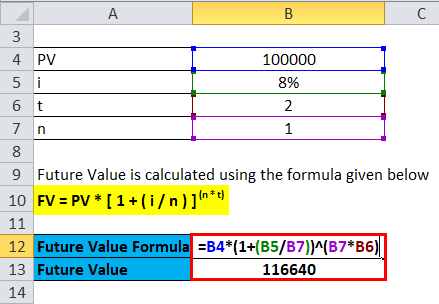

Time Value Of Money Formula Calculator Excel Template

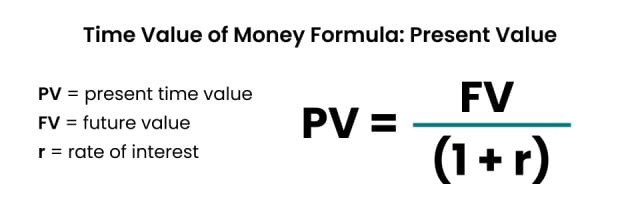

Lump Sum Present And Future Value Formula Double Entry Bookkeeping

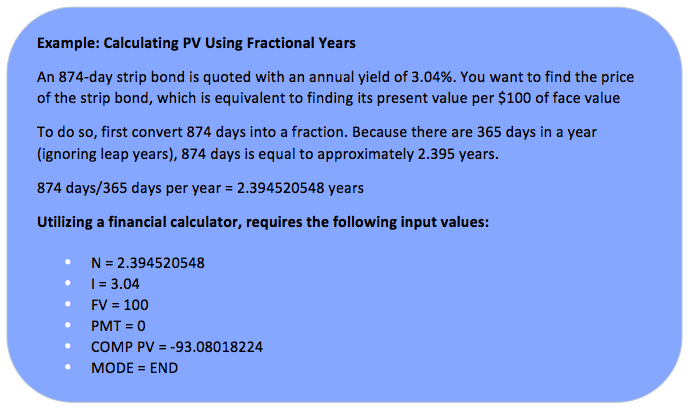

Time Value Of Money Tvm Calculations Plannerprep

Tvm Video 9 Calculation Of Pmt And Investment Period Youtube

Time Value Of Money Formula Calculator Excel Template

Time Value Of Money Tvm Calculations Plannerprep

Tvm Calculations

Time Value Of Money Tvm What It Means How It S Used Etc

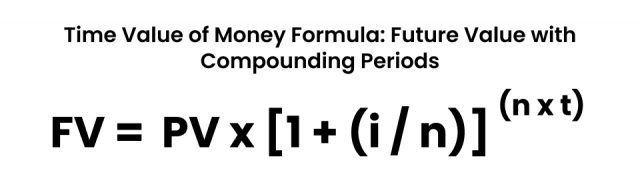

Time Value Of Money Tvm Formula And Example Calculation

What Is The Time Value Of Money Tvm Ppt Download

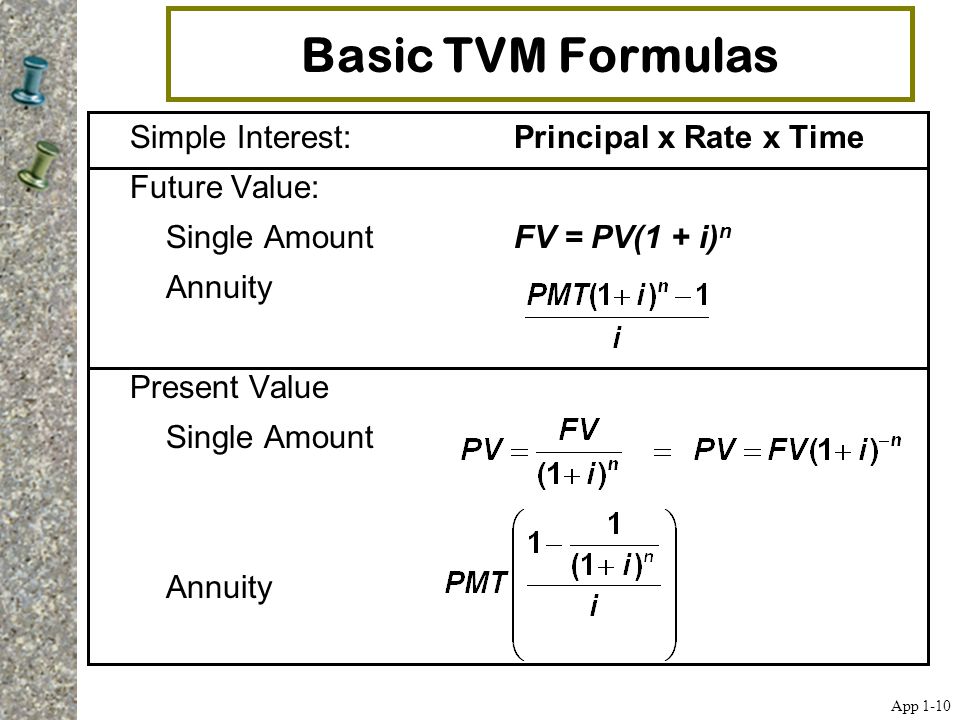

Chapter 1 Appendix Time Value Of Money The

Time Value Of Money Tvm Calculations Plannerprep

Chapter 1 Appendix Time Value Of Money The Basics Mcgraw Hill Irwin Ppt Video Online Download

Time Value Of Money Explained Meaning Formula Examples

Time Value Of Money Present Value Vs Future Value Youtube